What Is Breakout Trading?

Breakout trading refers to an attempt to join the market when the price goes beyond a set price range. However, an actual breakout is supposed to go together with by increased volume.

Breakout trading can be indicators with regards to a price breaking and closing over a downward trend line, horizontal inclination line or closure that goes beyond the resistance of the previous price range.

Once a breakout has been initiated, a discontinued loss can be placed at the bottom of the day to day breakout bar. If the trend continues, it should not destabilize the low of the daily breakout

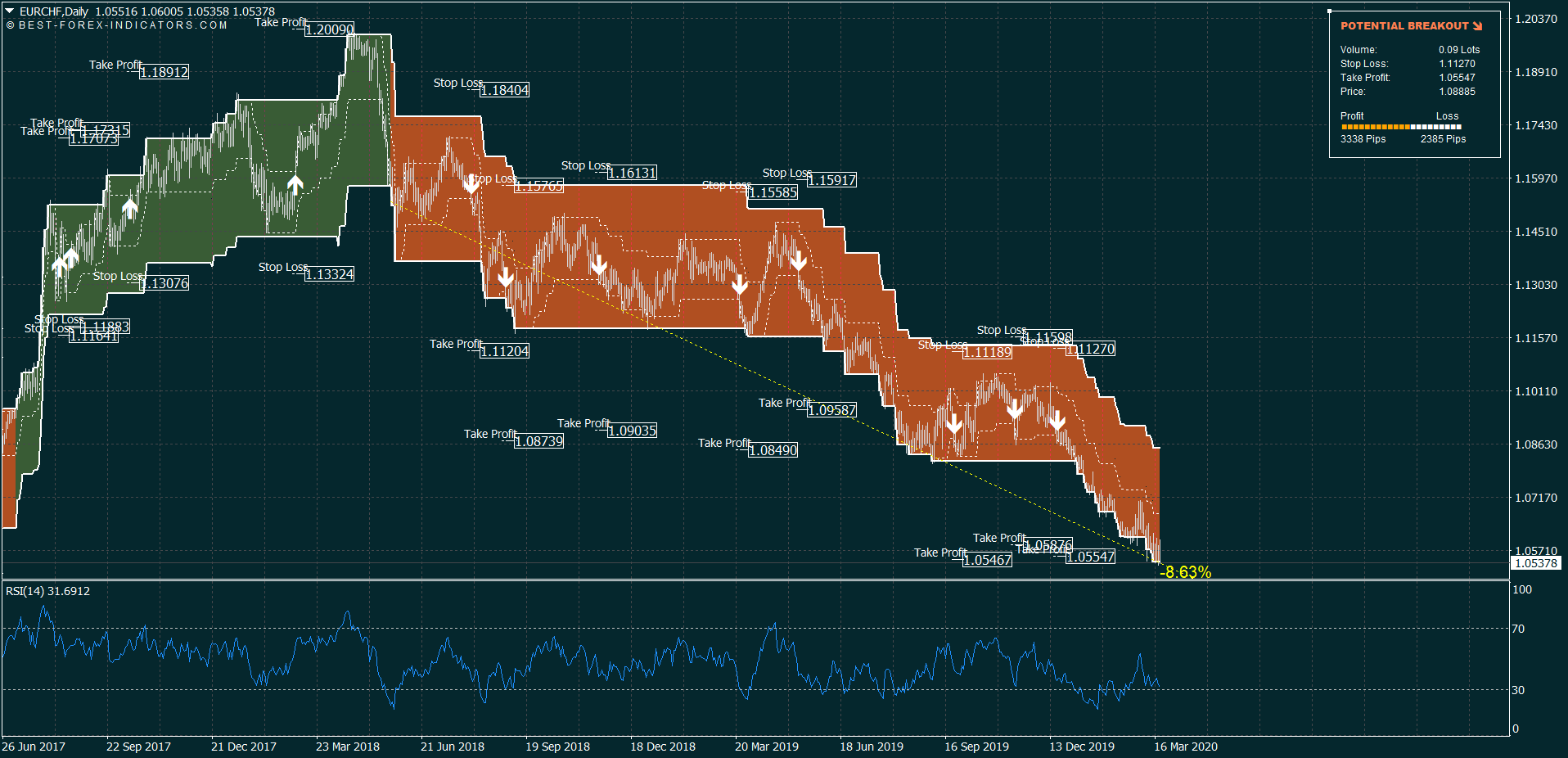

EUR/CHF Trading System based on Breakout Strategy

Above is a chart of the EUR/CHF.

- Time frame: Daily

- Trading Platform: Metatrader

- Technical indicator: Breakout Trading System V1

How To Trade Best Breakouts

In cases where the trend breakout to favor you, you can shift your opening stop loss from a close beneath the lowest point on the day of the break to an irregular loss stop for a short-lived moving average such as the exponential 10-day moving standard. If the tendency continues in your favor you can raise your trailing halt to the 5-day ema, a closure below the day before downgrade or a withdrawal underneath the RSI 70 in the course of parabolic trends.

Breakouts have a low success probability which is due to the fact that as a graph becomes more purchased with regards to the 70 RSI measure at the time of breakout. A closure or a break that goes beyond the 70 RSI can indicate the commencement of a parabolic movement.

Purchasing a breakout a without the knowledge of where the main resistance levels are at previous prices in the past on a plan it is generally a bad idea since the captive buyers could still be expecting to get back to selling with that strength.

Buying breakouts against the existing market trend generally does not work. Purchasing them with regards to the direction of the general trend means that you have better chances of successes. Breakouts in bear market are prone to failure, and very late breakouts in a bull bazaar also tend to fail.

When you purchase a breakout and it fails and returns to the low points of the preceding day, it’s the high time to leave. If the lows of the day breakout are held, there is an excellent opportunity of a new range as well as a new trend.

Buying on the expectation of a breakout before it essentially happens is typically a bad idea. You are supposed to look for an established breakout for the best chance of success, even if it leads to increased prices. It is better to be late in your investment venture and be on the right side rather than being punctual and while on the wrong side.

Going after a breakout after several days of change is not an advisable plan. You are supposed to have a profit cushion to facilitate a lasting hold and the huge part of the change can occur during the initial days of a breakout.

Purchasing breakouts in high yield stocks as well as commodities has a better likelihood of success as compared to indexes or large cap stocks.