What Does Swing Trading Mean

Swing trading is often confused as a trading strategy. Swing trading is a style of trading rather than a strategy itself. Swing trading is a style that involves holding on to a trade position for a period of days, weeks sometimes even months depending on the position taken.

Usually, it does not last longer than a couple of months. Basically, as a swing trader, you are a short term trader (holding a trade position for days or weeks). A Swing trader’s primary vehicle of discipline is the use of technical analysis but sometimes they do use fundamental analysis to support their technical analysis decisions.

A swing trader only looks to capture profit from a potential price move. Typically after a price movement hits their targeted price they would exit the trade and do not stay any longer, moving on to the next trade opportunity.

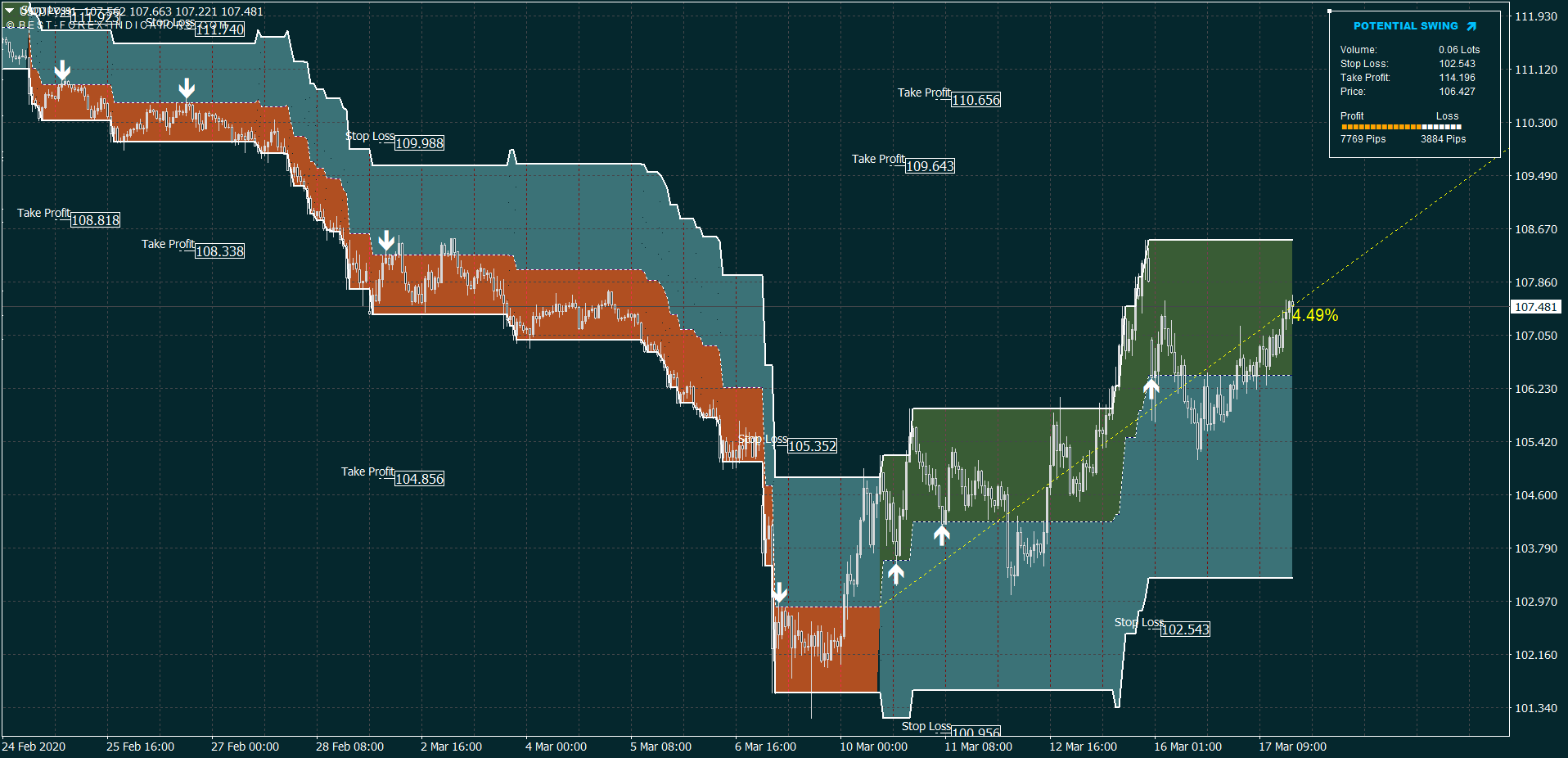

USD/JPY Trading System based on Swing Strategy

Above is a chart of the USD/JPY.

- Time frame: 1H

- Trading Platform: Metatrader

- Technical indicator: Swing Trading System V1

Swing Trading Action Plan

As a swing trader, you want to create a trading plan or strategy that has an edge in your chosen financial instrument (Stock, Forex, Commodity). Typically you want to look into the daily timeframe when devising your trading plan or strategy.

The daily timeframe is perfect for swing trading because it is not as volatile as lower timeframes like a 15-minute timeframe. This allows you to hold on to a trade position for days and weeks. Plus it is not as slow as the weekly and monthly timeframe which only generates one candlestick a week and month respectively.

The weekly and monthly timeframe is more suitable for investors who are looking to hold on to a position for at least a year.

The next thing you want to do is learn to identify patterns in the daily timeframe chart. Example, head and shoulder, inverted head and shoulders, flag and support & resistance.

Then you want to pair those patterns with key reversal candlesticks (i.e doji, bullish/bearish engulfing). The use of candlestick serves as an entry signal which helps is increasing the probability of the trade going your way.

Lastly, you also want to have good risk management. Understand that trading is a statistics game and you cannot win every trade. Having good risk management involves only risking 1% – 2% of your capital for every trade that you take.

Plus only taking takes that has a risk/reward ratio of 1:2 or 1:1.5. This way if you are only 50% right, you are still able to be profitable in the long run.

Summary

- Trading system – use a trading system to decide whether to buy or sell

- Patterns – Choose a trade pattern that works on the financial instrument of your choice

- Candlestick – Use candlestick in addition to trade patterns for better entry signals

- Risk Management – Trading is a statistics game and it is impossible to be 100% right in trading