Whether you are trading with forex, stocks, cryptocurrencies or CFD, these 3 trading strategies will help your trading sessions. If you want to achieve the best results in the shortest amount of time, integrate these into your system.

1. Breakout Trading Strategy

This trading strategy is very simple and suitable for beginners. The term Breakout refers to the breakdown of support level or resistance by the price of a specific financial product after a phase of sideways market.

We differentiate between types of Breakouts. When the price stops following the direction it was following in the last lateral phase, we use the term Continuation breakout. This time, instead of going backward, it breaks the level of support or resistance. This behavior indicates the creation of a trend.

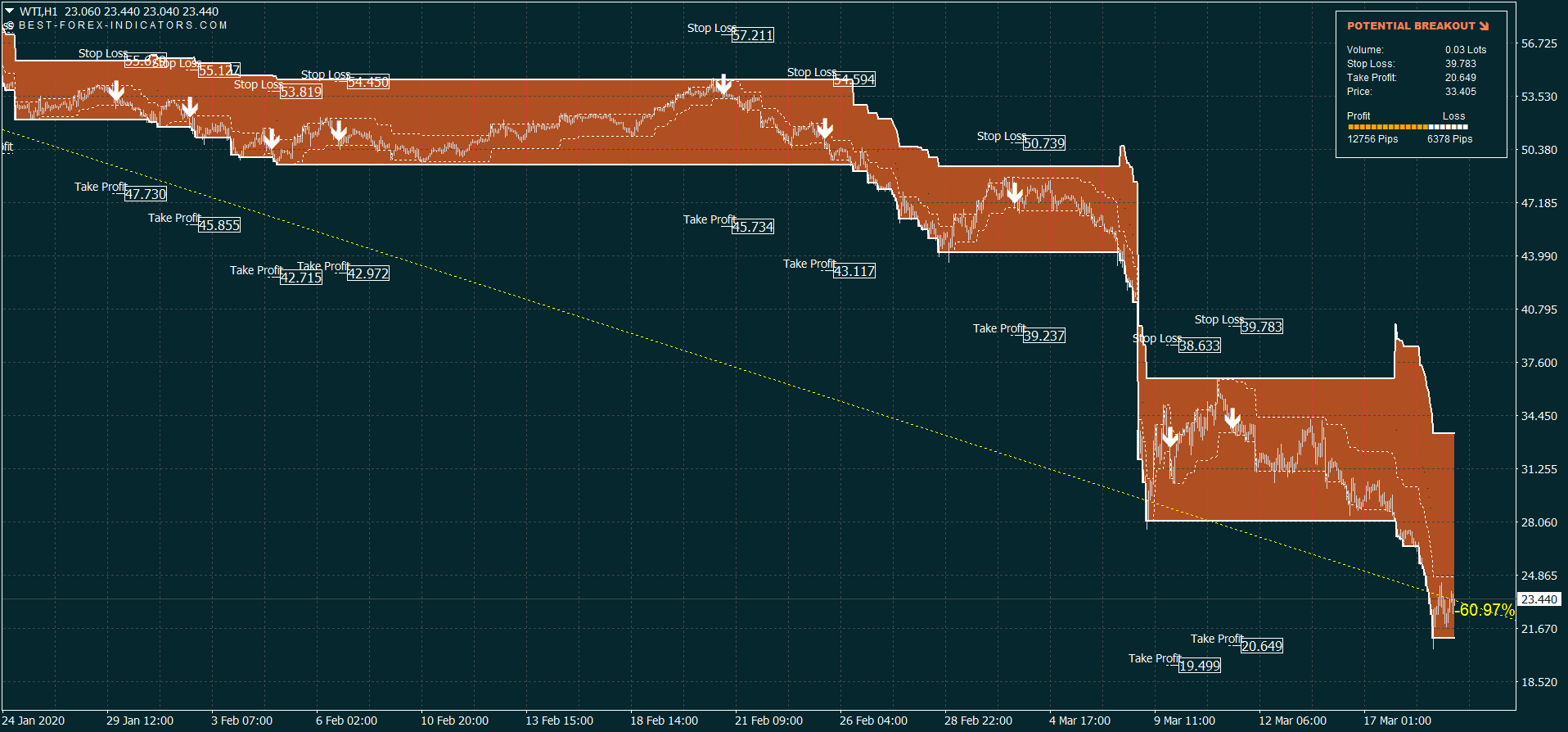

Crude Oil WTI Trading System based on Breakout Strategy

Above is a chart of the Crude Oil WTI.

- Time frame: 1H

- Trading Platform: Metatrader

- Trading Strategy: Breakout

- Technical indicator: Breakout Trading System V1

Similarly, we talk about a reversal breakout when, after the lateral phase, the price starts a trend in the opposite direction of the last candle of the resistance area.

Breakout represents a break in market stasis. A strong upward or downward impact trend is starting. This is where the speculation begins. The cause is a period in which a clear and defined trend does not prevail. Prices fluctuate in a continuous up and down. This reflects the indecision that reigns in the market. Investors do not know what to do. The two forces at stake, buyers and sellers, are equal.

When the balance ends, a chain reaction begins. The lucky ones stay like this or enhance their investment. On the wrong side, they quickly correct their position. The Breakout strategy has its risks and false flags. Unfortunately, these situations occur frequently. The mechanism that triggers them is not entirely clear. For this reason, some prefer to wait for the Pullback.

A Pullback is a return of the price to the previous level. After an initial upward or downward trend, the price gets back to the level preceding the trend itself. Then, it resumes following the just left trend.

2. Swing Trading Strategy

The concept of Swing Trading defines an entire investment philosophy, both in Forex and CFDs. The swing trader applies trading techniques to a long-term deadline. This method is the opposite of day-trading.

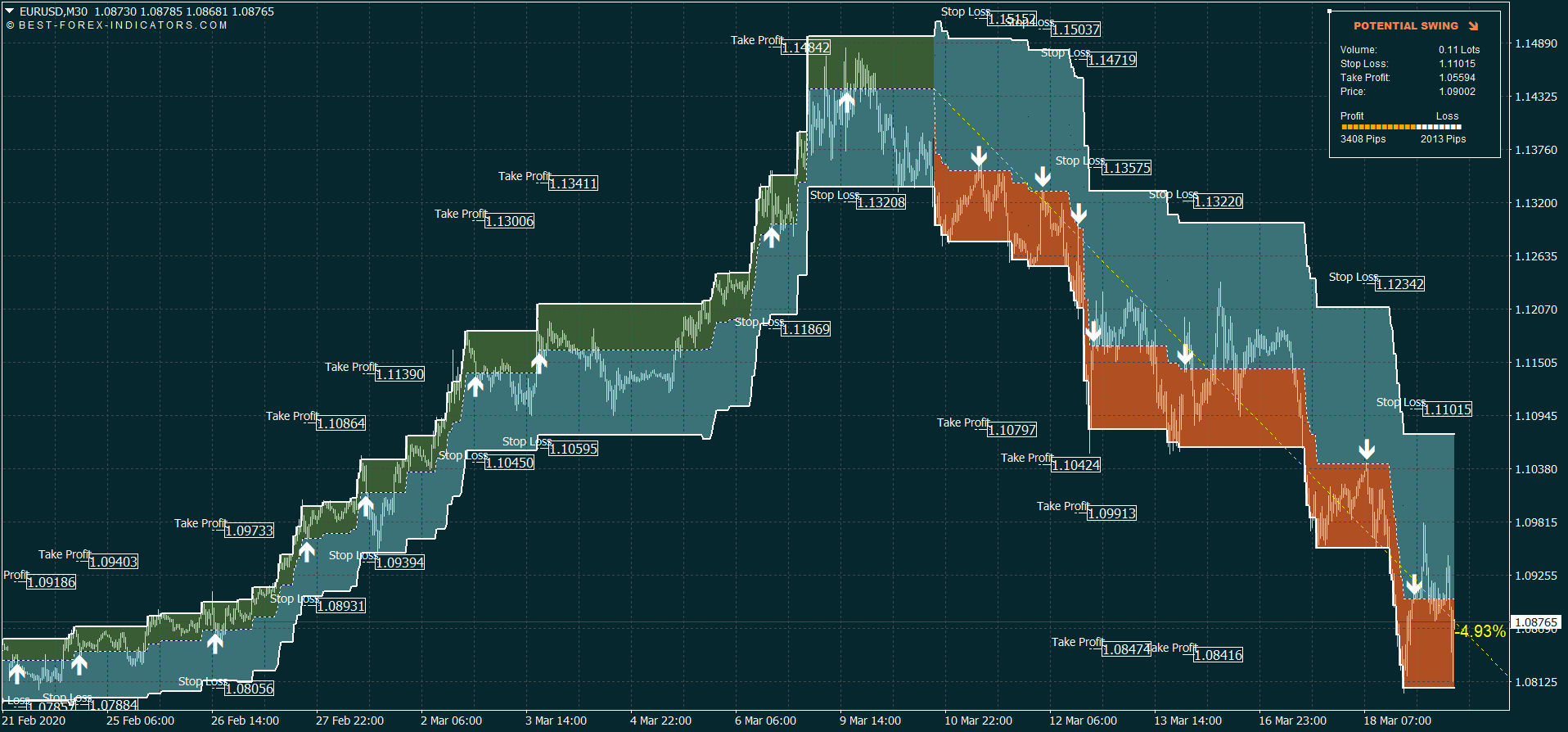

EUR/USD Trading System based on Swing Strategy

Above is a chart of the EUR/USD.

- Time frame: 30M

- Trading Platform: Metatrader

- Trading Strategy: Swing

- Technical indicator: Swing Trading System V1

The main advantages of Swing Trading derive from having more time available to carry out analyses. You work with less pressure. You can operate in multiple markets simultaneously and increase your earnings goals. High leverage is no longer a problem.

The trader assumes a risk known as overnight risk. You leave an open transaction in a closed market. It may happen that a piece of news occurred during the closure causes losses in the open positions in a sudden and uncontrolled way, and you can’t do anything about it.

The main strategy revolves around identifying swing trading points. These are the highest and lowest points. At these turning points, new trends will produce the desired outcome. To identify them, traders use specific indicators. Other tools include long-term average trendlines, Fibonacci levels, relative maxima, and minima, etc.

3. Trend Following Trading Strategy

This is another basic technique. Your instinct and technical analysis are the central protagonists. The trader follows the direction of the main trend relative to the chosen line. The risks involve the temptation to go against the trend to bet on small rebounds or corrections.

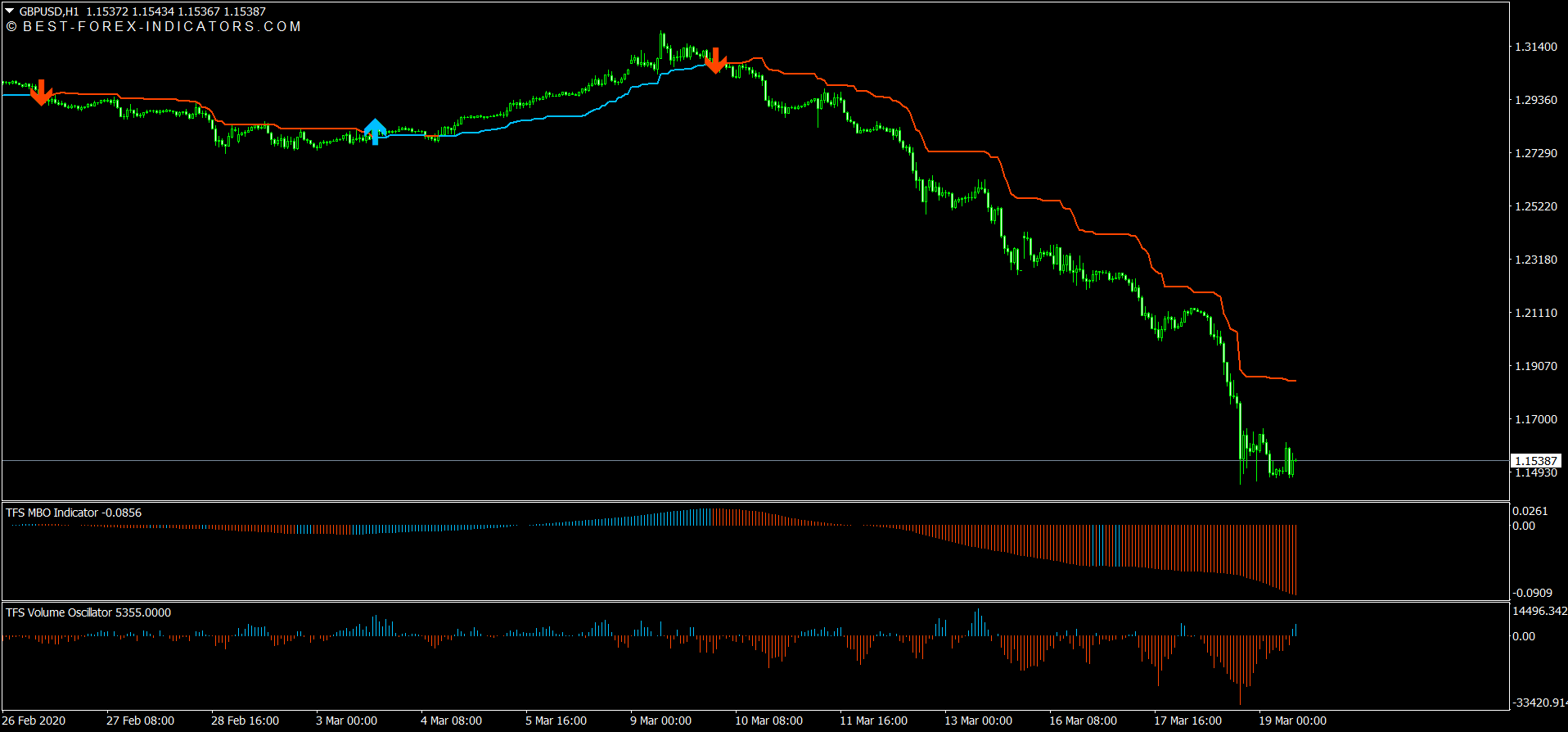

GBP/USD Trading System based on Trend Following Strategy

Above is a chart of the GBP/USD.

- Time frame: 1H

- Trading Platform: Metatrader

- Trading Strategy: Trend Following

- Technical indicator: TFS Trend Following System

It is very important to understand when the market is in a bullish or bearish trending phase, or if a lateral movement is taking place. The trader searches for past cycles with specific methods to identify trend reversals. They try to understand the general trend and its determining causes.

Whatever you decide to do, the aim is to always keep the market direction in mind.